Document Management Software For Accounting Firms

Introduction

In today’s fast-paced digital world, managing the sheer volume of invoices, receipts, sensitive records, and financial statements can be daunting for businesses. Many firms still rely on manual processes, such as paper-based invoice handling and data entry for accounts payable, which are time-consuming and error-prone. This inefficiency leads to productivity losses of up to 21.3%, with employees spending an average of two hours daily searching for documents. These challenges result in lost time, costly errors, inaccuracies, security breaches, and even compliance risks.

In an intensely competitive environment, such bottlenecks can be eliminated by adopting a paperless Document Management System (DMS) with advanced features and robust security.

Related Links

Why Accounting Firms need a Document Management System?

For Accounting and CPA firms, their client’s data and financial records are crucial and indispensable and if not handled carefully can lead to serious consequences. Another major challenge for these firms is secure document storage, limited accessibility, high costs, and quick retrieval. As a result, firms need to choose a reliable document management system or DMS for accountants. With a paperless office and robust security, accounting firms can focus on what truly matters.

An on-premise document management software or electronic document management software should be easier to use and scalable for firms of all sizes. It should efficiently handle large volumes of data, such as invoices, receipts, and other financial records, streamline workflows, and provide secure storage.

Docsvault’s on-premise Document Management Software with its simple and intuitive interface and cost-effective pricing can be easily integrated in your firm with no trouble at all.

Benefits of using Document Management Software for Accounting and Financial Firms

-

Paperless Office:

Accounting firms can save storage space and time by switching to paperless office. The digital shift streamlines the processes by automating manual and repetitive tasks.

-

Improved Organization and Accessibility:

A DMS can store a wide range of accounting documents, including source documents (like invoices, receipts, purchase orders, etc.), financial statements, and contracts in one central repository accessible to everyone. Powerful search functions can help with quick and easy search and retrieval. This reduces time spent searching significantly and improves overall productivity.

-

Enhanced Efficiency:

A document management system can empower your accounts and finance teams to streamline operations by digitizing documents and automating routine tasks such as document routing, approvals, and data entry. Leveraging AI-powered data capture and optimized workflows, DMS accelerates processing times and minimizes human error, resulting in significant efficiency gains.

-

Compliance and Security:

DMS equipped with features such as access control, multi-factor authentication, and audit trail, can ensure the confidentiality of sensitive client data. These along with version control and retention policies can help accounting firms comply with various regulations and industrial standards.

-

Reduced Costs:

Document Management Software is essential for all organizations and businesses, including Accounting and CPA firms. By digitizing and centralizing documents, DMS can significantly reduce costs associated with paper-based processes and physical storage.

-

Work from anywhere

Document Management Software enables accountants to securely access, store, and share files with team members and clients from anywhere, enhancing workflows, boosting collaboration, and maintaining compliance.

-

Improved Customer Relationships:

Faster information processing, can allow quicker responses to client queries. DMS allows seamless communication with clients by enabling easy sharing of documents. This can result in enhanced client satisfaction.

Key Features of a Document Management System for Accountants

-

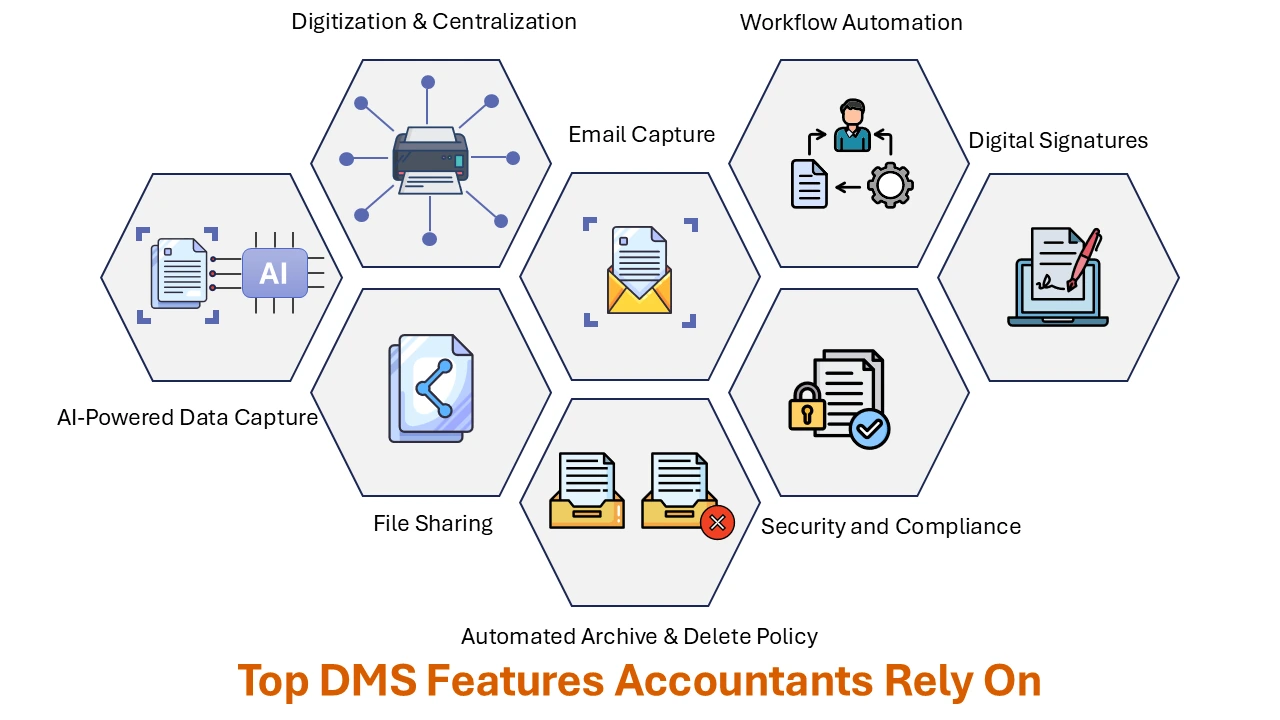

Digitization and Centralization:

Document management software converts all your paper documents like invoices, receipts, purchase orders, financial reports, etc. into digital files by using Docsvault scanning solutions.

All these documents are then stored in a centralized, secure electronic repository, ensuring easy access to everyone and eliminating the physical storage requirement.

-

AI-Driven Data Capture:

A DMS like Docsvault streamlines data processing for large document volumes of structured data (invoices, purchase orders) using AI-powered data capture, eliminating manual data entry and allowing employees to focus on higher-value tasks.

It automatically extracts key details from invoices, such as vendor information, invoice numbers, and amount, while assigning metadata for easy searchability.

The system intelligently classifies documents by content and automates naming and filing to predefined locations using captured metadata.

-

Email Capture:

Docsvault Document Management Software includes a smart automatic email capture feature that streamlines email management. This feature automatically captures, organizes, and indexes email communications and their attachments, ensuring that important messages are securely stored in your repository. By delivering these emails directly to a central location, it accelerates decision-making and enhances workflow efficiency.

Additionally, automatic email capture safeguards critical emails and attachments for future reference, compliance, and legal purposes. It is particularly useful for importing documents like faxes, orders, and invoices received as emails, making it an invaluable tool for managing essential communications effectively.

-

Workflow Automation:

Workflow automation in a Document Management System (DMS) simplifies and accelerates document processing by automating routine tasks such as accounts payable invoice approval.

Workflows are triggered automatically based on specific criteria, such as a document’s location or profile attributes, with actions executed at each stage—whether at the initiation, transition, or completion of the workflow.

Tasks can be automatically delegated to other users during scheduled absences or as needed, ensuring seamless progress without interruptions.

Throughout the workflow, the system can generate PDF versions of documents, export files along with their metadata to predefined locations, and even initiate follow-up workflows—all without requiring manual intervention.

Read: Streamlining Back-Office Operations with Workflow Automation

-

Digital Signatures:

Digital signatures allow you to sign documents electronically, ensuring their authenticity and integrity for approvals, contracts, and more.

Speed up the document signing process using Docsvault’s Signature Requests. This feature also enables you to request digital signatures from clients or vendors via email, streamlining the signing process. It guarantees document integrity and provides a secure, tamper-proof signature—eliminating the need for physical paperwork.

-

Files Sharing:

Docsvault’s DMS simplifies document sharing for accountants, enabling seamless collaboration with clients, team members, or vendors.

The Public Share Link feature allows you to generate URLs for files or folders in your repository, which can be shared effortlessly via email, instant messaging, or the web.

Additionally, the Document Request Link feature lets you create secure links for collecting documents. These documents are automatically stored in Docsvault, ensuring easy access and organized management.

-

Security and Compliance:

A DMS offers robust document security tools to safeguard sensitive financial information. These include user and group-based access controls, real-time activity reports, export restrictions, ownership overrides, and email notifications for activity updates. These measures ensure secure handling of financial data while maintaining visibility and control over document-related activities.

The audit trail feature allows tracking of all activities and tasks associated with a document, such as an invoice. This helps map the progress of each task and monitor versioning from creation to payment issuance.

Version Control further enhances financial reporting by enabling easy tracking, collaboration, and version notes. It allows users to roll back to previous versions, ensuring transparency and accuracy throughout the document’s lifecycle. This is particularly beneficial for accounting and finance professionals managing financial documents.

Moreover, compliance with industry-specific regulations is critical to avoid legal consequences. A DMS supports this by enabling secure document control, minimizing the risk of non-compliance and data breaches to critical financial data.

-

Automated Archive & Delete Policies:

DMS allows you to configure the system to automatically archive and delete documents, ensuring compliance with legal and industry retention standards.

Best Practices for Implementing a Document Management System in Accounting

The accounts and finance department deals with large volumes of financial and confidential documents that need proper organization and management. If not done properly, can lead to serious repercussions.

Thus, it becomes essential for them to follow the best practices for implementing a secure and reliable Document Management System.

- Assess your needs and set goals: Identify your firm’s specific challenges such as manual data entry, handling large volumes of documents, or compliance requirements. Set clear objectives to evaluate the success of DMS implementation.

- Choose the Right DMS: Choose the appropriate DMS that aligns with your firm’s requirements. Make sure it supports scalability, automated workflows, fine-grain security, and advanced search capabilities along with ease of use.

- Strategize the seamless transition: Strategize the plan to migrate and digitize all the documents ensuring proper organization and accurate metadata assignment.

- Automate repetitive tasks: Automate repetitive tasks such as invoice approvals by establishing workflows to adapt to your requirements..

- Ensure compliance and security: Use advanced features such as access control, multi-factor authentication, and audit trails to safeguard sensitive information. Conduct regular compliance checks to ensure adherence to industry regulations.

- Standardize document naming and filing: Create a consistent naming convention and folder structure to streamline the organization.

- Integrate with other accounting tools: Integrate seamlessly with other accounting tools such as ERP systems.

- Train your team: Provide training to employees on using DMS efficiently. Focus on features such as workflow automation, document indexing, and security. Provide updates on new functionalities.

- Monitor performance: Regularly monitor performance to identify bottlenecks in workflows and inefficiencies in processes.

How Docsvault has helped Accounting and Finance Teams?

Viant Medical, a prominent medical equipment manufacturer based in Massachusetts, employs over 6,000 people across 25 locations worldwide. Their accounts team struggled with managing its invoice approval processes due to an extensive supplier network, a diverse product portfolio, and complex regulatory requirements. These challenges made manual invoice processing both time-consuming and prone to errors. By adopting Docsvault’s document management software (DMS), Viant Medical successfully automated and streamlined its invoice approval process, resulting in improved efficiency, enhanced supplier satisfaction, and better compliance. Read the full case study.

Steme Holdings Pty Ltd., an Australian investment company, struggled with managing paper documents and delays from a manual filing system. By adopting Docsvault DMS, they significantly eliminated paper use and reduced the time spent retrieving records for receipts and warranty claims. Read the full case study.

Packer Thomas, a CPA & Business Consulting firm, struggled while handling a lot of sensitive documents and in general administration. Docsvault proved to be of great help in securing sensitive documents and improving general administration. Read the full case study.

Conclusion

Adopting a secure and reliable accounting document management like Docsvault empowers accounting and CPA firms to streamline and automate routine manual tasks. By minimizing time spent on repetitive processes, reducing operational costs, and ensuring compliance, a DMS allows firms to focus on what truly matters—delivering exceptional service to clients.

More than just document organization, a DMS accelerates approval processes, boosts productivity, and transforms how accounting professionals work. It lays the foundation for growth, efficiency, and long-term success.

Discover how implementing a robust document management solution can redefine your accounting practices. Contact Docsvault today and let us help you stay ahead in an ever-evolving industry.

This article covers:

- Introduction

- Why Accounting Firms need a Document Management System?

- Benefits of using Document Management Software for Accounting and Financial Firms

- Key Features of a Document Management System for Accountants

- Best Practices for Implementing a Document Management System in Accounting

- How Docsvault has helped Accounting and Finance Teams?

- Conclusion